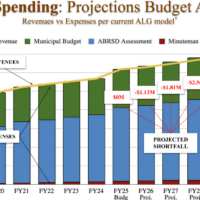

A tax limit override that, if approved by Acton voters, would raise property taxes beyond the Proposition 2½ statutory limits has recently been discussed at the Select Board, Finance Committee, and Acton Leadership Group meetings. It seems likely, following those discussions, that an override will be on the ballot at the next town election. However, important details have yet to be decided. Those details include: how much revenue should be raised, how many fiscal years the additional revenues should cover, and how the override should be structured.

Acton voters were last presented with an override decision at the March 29, 2005 annual town election; and details similar to the above were discussed in preparation for that election. The structure of the override was discussed at the Finance Committee, and those discussions may be useful as the town prepares for the next election.

It is interesting to note the parallels between 2005 and now. From the September 14, 2004 Finance Committee minutes,

“[An ALG spreadsheet] show[s] a decline in incremental revenues of about $650,000. This is a result of using non-recurring revenues in FY05. If all of the FY04-05 cuts were restored and additional minimal staffing increases made, this would result in a budget deficit of about $6.5M. There was also some discussion of revenue sharing between the town and school budgets. Mr. Ashton presented a spreadsheet, which Mr. Chinitz has revised, showing how the split has varied over the last 10 years. Ten years ago, the split was 39.1% for the town; in the FY05 budget, the town’s share is only 31.5%. The decline, in part, results from budgets emphasizing personnel and cut-backs in operating capital, which disproportionately affects the town side.”

The current split between Acton’s share of the Acton-Boxborough regional school district budget and Acton’s FY2024 municipal budget is 65%:35%. $6.5M (million) in September 2005, adjusted for inflation, is about $10,509,900 in December 2023.

The Health Insurance Trust was also an issue in 2005. From the Finance Committee minutes, January 2005: “…we are facing a series of large claims this year … big enough to cause a problem, but not large enough to trigger our re-insurance.”; and March 2005, “The municipal budget includes a 25% rate increase for health insurance…”; “Rheta Roeber asked if this is the time to stop self-insuring. John Ryder explained that at least over FY2000 to FY2004, we have saved about $5M compared to what we would have paid for our policies, which are very generous compared to most products in the market.”

At the Nov. 9, 2004 Finance Committee meeting, Committee member Gim P. Hom made a presentation entitled “Pyramid Overrides Menu Overrides”; that presentation illustrated options that were later described in detail in the 2017 “Proposition 2½ Ballot Questions” document from the Massachusetts Division of Local Services (DLS). (Proposition 2½ is relevant because it it the 2.5% limit on property tax increases that is ‘over-ridden’.)

In a pyramid override, two or more spending levels are proposed; the greatest dollar amount that passes is enacted. The 2005 Board of Selectmen (as the Select Board was then known) opted for a pyramid override. Questions 2 and 3 on the 2005 Annual Town Election ballot were almost identically worded: “Shall the Town of Acton be allowed to assess an additional $3,800,000…” (Question 2) or $4,500,000 (Question 3), “…in real estate and personal property taxes for the purposes of funding the operating expenses of the Acton Public Schools, funding the Town’s regional school district assessment for the Acton-Boxborough Regional School system, funding the operating expenses of the Police Department, Fire Department …”. Question 2 passed, with 55.7% voting “Yes”, 43.5% voting “No”; Question 3 did not pass, with 46.4% voting “Yes”, 52.5% voting “No”.

The DLS document cited above provides an example of a menu override, a series of questions naming specific municipal departments:

Shall the Town of Yourtown be allowed to assess an additional $250,000 in real estate and personal property taxes for the purposes of funding the Fire Department for the fiscal year beginning July 1, ?

Shall the Town of Yourtown be allowed to assess an additional $250,000 in real estate and personal property taxes for the purposes of funding the Police Department for the fiscal year beginning July 1, ?”

While the Select Board makes the final decision on the ballot question, Select Board and Finance Committee members have spoken of familiarizing the electorate with the urgency of current financial issues; one term that has been used to describe that familiarization is how to ‘socialize’ the upcoming ballot question(s). That process might include a public discussion of override question options.

Tom Beals is a volunteer reporter from Acton.