Acton and Boxborough residents rely on essential services every day, from our top-tier schools and public safety teams to the Department of Public Works crews maintaining our roads. However, a new report from the Massachusetts Municipal Association (MMA) titled, “Navigating the Storm: Charting a Course Toward Fiscal Stability” warns that the financial foundation supporting these services is under intense pressure.

Following up on its October “Perfect Storm” analysis, the MMA is now outlining a strategic path to rescue cities and towns from a “vise-like squeeze” caused by relentless cost increases, rigid revenue limits, and a long-term erosion of state aid. For Acton and Boxborough, these recommendations could represent a significant shift in how local services are funded and how much of that burden falls on property taxpayers.

The “structural hole” in local budgets

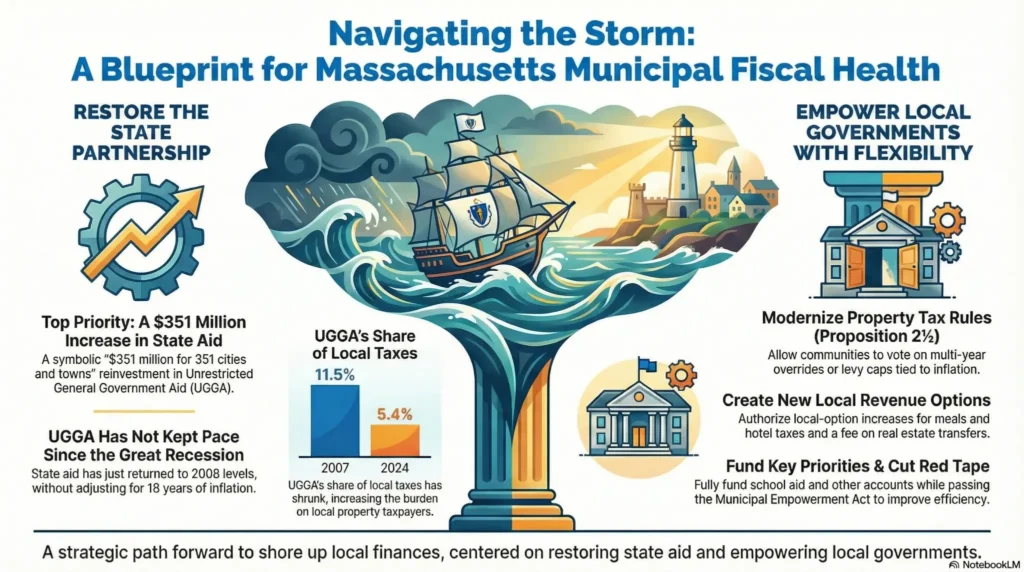

The heart of the issue lies in Unrestricted General Government Aid (UGGA). Unlike specific grants, UGGA gives towns like Acton and Boxborough the flexibility to fund local priorities, whether that is senior center operations or public works.

The MMA report highlights a startling trend: while the Commonwealth’s economy has grown, its partnership with local governments has withered.

- In 2007, UGGA accounted for 11.5% of total local taxes statewide.

- By 2024, that share plummeted to 5.4%.

- It took 18 years for UGGA funding to simply return to 2008 levels, without accounting for inflation.

This decline has created a “long-term structural hole,” forcing municipalities to lean ever more heavily on local property taxes to keep the lights on.

The “351 for 351” proposal

To fix this, the MMA is calling for a bold, restorative investment they call “351 for 351”. The plan urges the Commonwealth to provide $351 million in new UGGA funding for the 351 cities and towns in Massachusetts.

This 26.5% increase over current levels is designed to restore state aid to its post-recession average of 6.78% of local taxes. For communities like Acton and Boxborough, this would mean immediate and meaningful relief for a budget strained by the rising costs of health insurance, construction, and energy.

New Tools for Taxpayers and Towns

The report acknowledges that Proposition 2½, while a staple of Massachusetts fiscal policy, can be “unreasonable” in a high-inflation environment. The MMA is not suggesting an end to the law, but rather more flexibility for local voters to manage it. Key recommendations include:

- Multi-year overrides: Allowing voters to authorize a structured override that phases in over several years to avoid “tax shocks.”

- Adjustable levy caps: Permitting a town, via referendum, to temporarily or permanently tie its levy limit to an economic indicator like the Consumer Price Index (CPI) instead of the fixed 2.5%.

- Targeted relief: Expanding the ability for towns to offer means-tested tax exemptions for vulnerable populations, such as seniors and veterans.

Expanding local revenue options

Beyond property taxes, the MMA is advocating for the state to grant municipalities more “local option” revenue tools to diversify their income. These include:

- Raising the ceiling on local meals and lodging taxes.

- Adding a local-option surcharge on motor vehicle excise bills.

- Implementing a real estate transfer fee dedicated specifically to local affordable housing trusts.

A call for stability

Ultimately, the MMA argues that the fiscal health of the Commonwealth depends on the stability of its 351 individual communities. By restoring state aid and providing more flexible local tools, the MMA believes Massachusetts can preserve the essential services that define our quality of life while making the state more affordable for residents.

As Acton and Boxborough begin their own budget deliberations for the coming year, the “Navigating the Storm” report serves as a reminder that the challenges voters face at Town Meeting in both communities are part of a much larger, statewide conversation about the future of the state-local partnership.

Reactions of town officials and state legislators

Town officials in both Acton and Boxborough as well as local legislators were asked to comment on the new MMA recommendations.

Dean Charter, chair of the Acton Select Board, said, “I applaud the Massachusetts Municipal Association’s efforts to bring the problem with insufficient state funding of municipal services into the forefront of public understanding. In my almost 50-year career in public service I have seen the support steadily erode. Almost all the services that touch the public are provided on the municipal level: public safety, public works, libraries, recreation, inspectional service, and services to our vulnerable seniors. These services are essential, and the state, with more options for raising revenue, should do more to provide funds so that the services can be delivered locally.”

Tori Campbell, chair of the Acton-Boxborough Regional School Committee, said, “While my work centers on education finance and Chapter 70 reform, stronger Unrestricted General Government Aid and greater flexibility in revenue generation can help relieve pressure on town budgets overall. Greater fiscal stability makes collaboration among school committees, finance committees, and select boards more effective, and helps avoid pitting core services against one another.”

Kristin Hilberg, chair of the Boxborough Select Board, said, “Until the Commonwealth is willing to provide reasonable municipal aid and change Proposition 2.5 into a model that works with current economic trends and forecasts, we need to be proactive instead of reactive every time we see a looming levy limit. Boxborough has been fortunate to have had enough new growth and fiscal prudence over the years to keep us out of the fray (it’s been 20 years since we’ve had to have an override), but if we expect to maintain a basic level of services in both the town and as a partner in the ABRSD we need to see some systemic changes coming from the top. I applaud the MMA for putting the package of recommendations together and hope that continued exposure to the ideas and suggestions helps prod the Commonwealth into developing new fiscal strategies.”

Antony Newton, chair of the Boxborough Finance Committee, said, “The MMA article highlights some of the challenges we are facing in Boxborough. These are in addition to our more specific local issues including Boxborough’s increasing share of regional school enrollment, declining new growth, and erosion of our commercial tax base. Like many other towns we will face an Operational Override in the near future.”

State Senator Jamie Eldridge said, “I greatly appreciate the two reports issued recently by the Mass Municipal Association (MMA), under the theme of ‘Navigating the Storm: Charting a Course Toward Fiscal Stability.’ They highlight the reality of too many Massachusetts cities and towns, that over the past 25 years, since the 2000 income tax cut from 5.95% to 5%, municipal aid to towns and cities has declined. I do think it is time to set up a commission to review Unrestricted General Government Aid, as well as the Massachusetts State Lottery, and Proposition 2 1/2. The more municipal officials, including select board members, city councilors, school committee members, and mayors, who directly advocate with their legislators about the need for bold action on Beacon Hill, the more likely comprehensive legislation will pass. Reflecting on the 2000 tax cut passed by the voters, it’s important to reflect that if cities and towns and their local elected officials really want to see an substantial increase in state aid, Massachusetts will also need to raise revenue, which is why I also am a strong supporter of making sure wealthy people and big corporations pay their fair share of taxes to the Commonwealth.”

State Representative Danillo Sena said, “We always need to be looking for ways to support our communities. I appreciate the work of the MMA in highlighting some of the major challenges facing our municipalities, and I look forward to working with our colleagues to address them.”

State Representative Simon Cataldo said, “Ensuring we have strong state aid, in the forms of unrestricted general aid, Chapter 70 aid for schools, and Chapter 90 aid for local roads, will be a top priority of mine again this cycle. I look forward to working with my colleagues and local leaders to help Acton and the other municipalities in my district weather the financial headwinds that all towns and cities across the Commonwealth are facing right now.”

Greg Jarboe is the Acton Exchange beat reporter for the Council on Aging and also writes on a variety of topics of community interest. He is a member of the Town of Acton Finance Committee and the Public Works Facility Building Committee.